It should come as no surprise that the interest rate on the US Government 10-year bond is the most widely used indicator to broadly speculate on the future direction of equity prices and economic activity in general. US Government debt is generally considered “risk free”.

Changes in risk free interest rates can be seen from two perspectives: from the business and the investors’ perspective. From an investor’s point of view, a rising risk-free rate of return signifies a stable government, a confident treasury, and, ultimately, the ability to expect high returns on one’s investment. That’s the good part. On the other hand, for businesses, a rising risk-free rate scenario can be worrisome. The companies would have to now meet the

investors’ expectations of higher returns by improving stock prices. It might turn stressful as the business would now not only have to show good projections but also must thrive on meeting increased levels of expected returns. So, you can see how rising rates can make companies with high growth expectations less attractive due to the risks of not meeting those expectations.

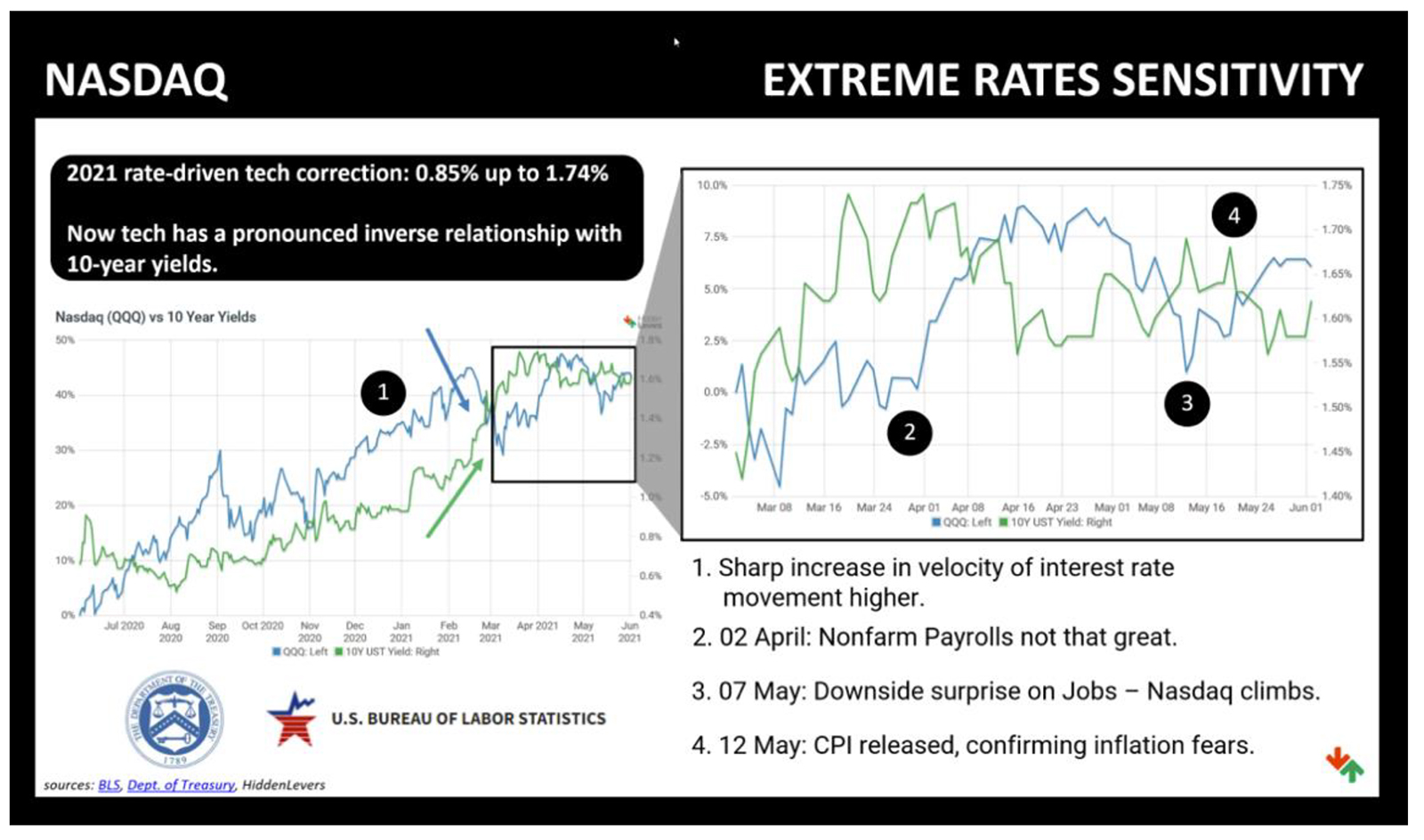

Below is a slide from a presentation I saw recently that illustrates this relationship. The chart uses a NASDAQ Index ETF (QQQ) as it is heavily weighted in high growth technology companies whose valuations are most susceptible to changes in interest rates. Beginning in June 2020, we saw the 10yr rate decline sharply to a low of 0.52% in early August. At the same time, growth stocks started to sharply rebound. You can see how rates gradually rose to pre-pandemic levels. The index has followed along as general economic activity started to return to something close to normal. At the beginning of 2021, much of the rebound in large technology had taken place leading to questionably high valuations. At that time, the historical inverse correlation to changes in interest rates relative to stock valuation returned. The slide notes the causes for recent spikes in rates and illustrates the simultaneous negative price action of the QQQ ETF.

Inflation Rate Outlook

The crux of my discussion herein is to highlight how important it is to understand how future forecasts of interest rates influence investment strategies. The largest factor we face in thinking about rates is the outlook for inflation. As the chart above notes, the May 12th inflation report came in much higher than expected driving the 10-year rate sharply higher which caused a quick sell-off in the index. As inflation fears subsided, the index made a full recovery.

The raging debate now is centered on the outlook about how sticky or transitory are the factors that impacted the April Consumer Price Index (CPI) report the most. The rise in energy prices had by far the most impact on the surprise report. The sharp rise in many other commodities and semiconductors also contributed. Will the price of these CPI components maintain their sharply higher levels over the next 1-2 years? The general sense from many analysts is that the prices will moderate over that time frame. Many point to the unique situation we are in where the global supply network will gradually return to normal, and prices will become more rational.

We place the odds of such an outcome at 60/40. While inflation may gradually rise over the next 1-2 years, something the Federal Reserve would like to see, it will be well telegraphed to the market which should help avoid price shocks like we have seen over the past few months. That should make for stable outlook for the 10-year bond rate over the next year. It would take too long to go through opposing views suggesting we are headed into a rapid inflationary environment. In short, their belief is that many of the price increases we all see out there are

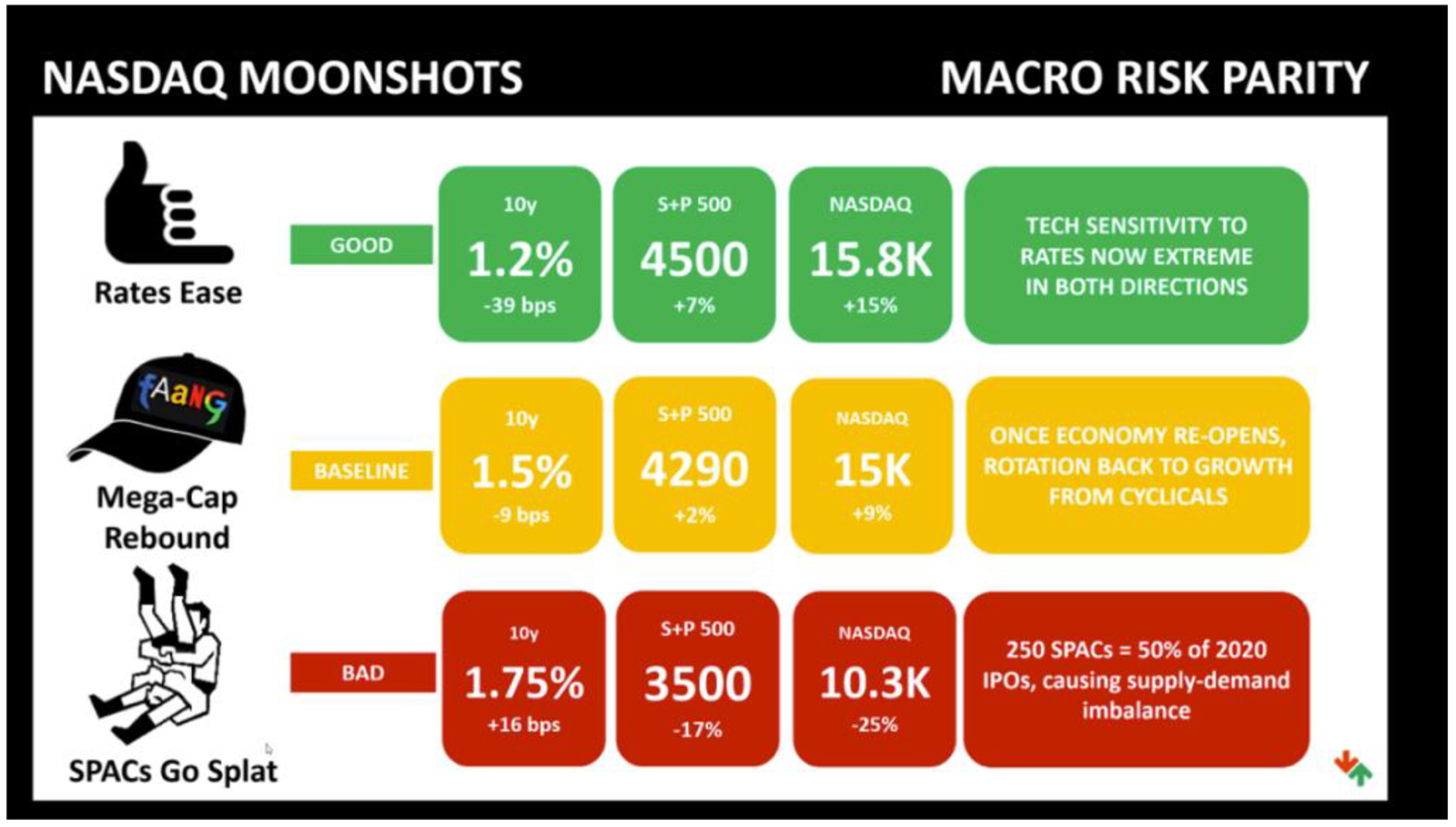

not going away soon. They also point to the long-term inflationary risks of pumping so much cash into the economy defining inflation as “too many dollars chasing too few goods”. I will leave it there. Below is another slide from the same presentation that forecasts some numbers related to the impact of rates on market valuations. Mind you, this is just one firm’s view, but it is a good forecast summary purely driven by changes in the 10-year rate. In my view, the “Baseline” outlook is the most likely outcome over the next 6-12 months.

Wrapping Up

As we speak with all of you over the coming months, the outlook for inflation and changes in the 10-year interest will be a common topic. It is easily the most important issue facing the future trajectory of market performance. The jarring hit to the global economy from the pandemic is something the markets haven’t faced in many decades. Efforts to combat COVID globally have struggled, which may drag out the recovery for at least the next 1-2 years. If so, interest rates should remain fairly stable leading to an attractive investment environment.

Side Note – AMC Stock Offering – The Greater Fool Theory in Action

For MEME stock followers, here is a quote from the recent AMC offering prospectus:

“We believe that the recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last. Under the circumstances, we caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment.” (Emphasis original). Enough said.

We hope everyone is well out there. Please call if there is anything you need.

Cheers!