It’s old news we have a supply chain problem that it is causing severe shortages in all manner of goods driving up prices nearly across the board. The question is “How did we get into this situation and when will we get back to normal?” I have read numerous articles and spoken with former colleagues who are paid to opine on such things. The responses have been varied but follow the general theme that most manufacturers and shipping companies made critical mistakes predicting consumer demand. Those decisions combined with the production of goods being hampered by COVID outbreaks and manufacturing shutdowns has led to a severe shortage of goods.

How did we get here?

In the late 1970’s, US and global manufacturers aggressively embraced “Just-In-Time” inventory management. This approach to manufacturing led to less inventory on hand which meant lower costs, better margins and greater profits. Since then, basically all companies who make things were holding only the amount of inventory necessary for shorter periods of production/sale and depended on replenishing inventory more frequently. That strategy worked very well right up to when it didn’t.

A multi-decade lack of government and private sector investment in supply chain infrastructure is a major problem both here and abroad. Add in some federal and state regulations that restrict and deter investment in new facilities and throw in a global pandemic and here we are.

To illustrate, at a local level in California, home to Los Angeles and Long Beach ports, the 17th and 22nd largest in the world and are responsible for 40% of all shipping containers entering the US are at a near standstill. US port traffic has also been severely impacted by California Assembly Bill 5 (AB5) which was signed into law on 1/1/2020. In short, it requires trucking companies to treat their drivers as employees. A lot of drivers want to be owner-operators, not employees. AB5 eliminates that desire for independence and space so many left the state. So now there is a severe shortage of drivers. Such is the law of unintended consequences.

The Consumer Returns with a Vengeance

The consumer surprised everyone by buying more discretionary goods than normal in 2020 and continuing today. Think home furniture/home improvement projects/consumer electronics etc. as areas that experienced rapid demand growth in a very short period. This created an enormous amount of unexpected demand. After vaccines were introduced, unmet demand soared, and the already damaged supply chain simply could not keep up.

The result:

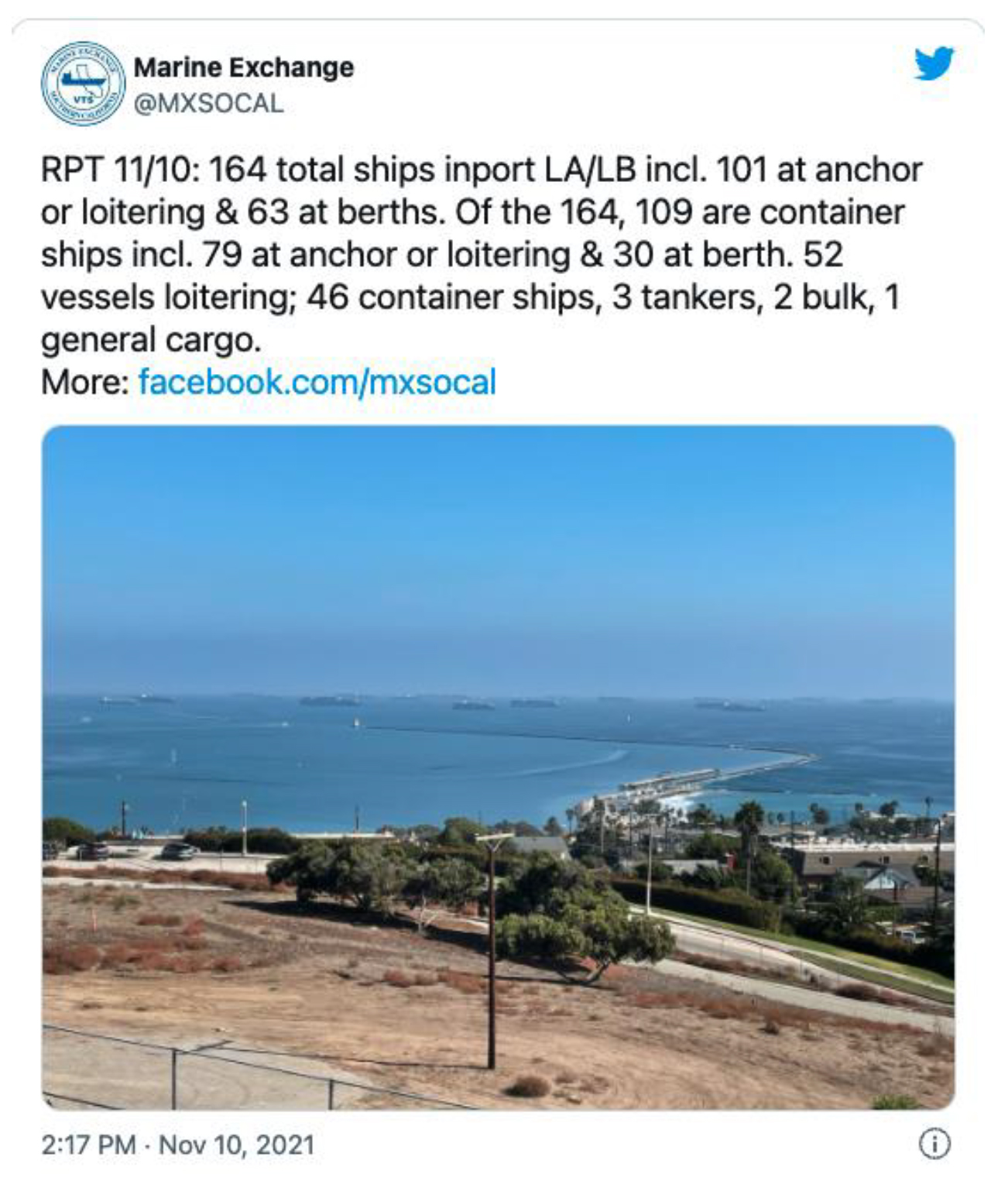

- Los Angeles and Long Beach ports are barely operating, and Oakland and San Diego ports are much the same.

- No space to store the thousands of containers that are sitting on ships anchored outside the ports.

- No place to store empty containers sitting on truck chassis’ meaning they can’t pick up a full container for delivery.

- Severe shortages of shipping containers – “Containergeddon” as the industry describes it.

- Severe driver shortages.

- Environmental laws Including the prohibition of diesel-powered equipment and forbidding idling of heavy equipment for more than two minutes.

An update as of November 10. Note the 164 total ships in port is an all-time high. To put it into context, there would normally be about 17 ships at anchor outside those ports.

How/When Will It End?

The old analogy “pig in the python” applies well here. Everyone expects all these disruptions to eventually subside, but obviously no one can determine when. There are historic numbers of container ships floating outside every major shipping port in the world. Economists and logistics analysts have said that these problems could continue throughout 2023.

What could accelerate the unwinding of this mess:

- Signs of movement to lift restrictions on container storage facilities to allow for greater capacity at the ports – possibly on government land

- Zoning rule changes at the local level by Executive Order to expedite expansion

- Reverse the years of underinvestment in supply chain resilience supported by government funds for infrastructure

- Work rule hour changes to facilitate 24/7 port operations

- Seeking more creative ways to move cargo by incorporating greater train capacity and reducing the number of 1,000+ mile truck journeys thus freeing up more for port operations

None of the above can be done quickly so progress will obviously be slow. A sliver of light can be seen in a recent Bloomberg survey of shortages that indicates a slight decline from previous readings.

Risk of a Boom-Bust Scenario

There is a real risk that the markets are ignoring, for now at least, that when supplies return to normal, inflated prices will recede leading to lower-than-expected returns which is never good for the markets. The financial markets are a discounting mechanism in that near term economic conditions are not as important as six-to-twelve-month forward forecasts. If manufacturers increased production in excess of normalized demand, then we could relive the boom-bust scenario. Lead times for large capital equipment orders (think ships, semiconductor manufacturing, etc.) can take years which raises the risk of an eventual glut in production. As we move through 2022-2023, signs of such overcapacity will show up in production and capital expenditure surveys which are all closely followed. Hopefully we won’t relive past boom-bust cycles.

Christmas?

Order early and often or better yet, shop local and support small merchants. Prices and shipping delays are expected to continue rising. I read where retailers such as Walmart, Target, Home Depot, Costco and Dollar Tree are chartering their own ships to deal with the slowdown in sea networks that handle 90% of world trade. All shipping companies are warning of significant increases in delivery times so don’t delay.

Wrapping Up

The impacts of rising prices related to all of this has greatly increased consumer costs for all manner of goods. Leading economists and policy makers are beginning to rethink their outlook that all of this would be transitory. I wrote about inflation recently highlighting the tug of war between those who feel higher prices are transitory and those who see this as a much larger threat. I dare write again about inflation since it isn’t the most exciting thing in the world, but it is safe to say that higher inflation will be here through 2022 into 2023 before hopefully cooling off.

These outlooks are not lost on us. The strategies we use have been shifting to a more conservative posture of late in anticipation of Federal Reserve policy changes that may lead to raises in the Fed Funds rate earlier and more often than expected. If so, it will likely dampen market outlooks for 2022 relative to the performance of markets we have seen this year. We also can’t ignore the very rich and in some cases ridiculous valuations of many popular technology stocks. Comparisons to the technology bubble of 2000 are growing. The markets don’t seem to care much now but at some point, we suspect they will.

For those who may be considering investment actions that have year-end deadlines, please act early and give us a call to help accomplish them. Both Schwab and Fidelity have warned us about the potential for a year end crush of requests that may make it difficult to complete if they aren’t in by December 20, or sooner. We hope everyone will get some time with family and friends as the holidays approach.