A lot has been written about the impacts national elections have (or do not have) on financial markets. Studies have been done over the years to try and determine if changes in political party control of Congress and the White House (WH) lead to subsequent outperformance or underperformance of financial markets. Time has also been spent analyzing market action and returns leading up to and after midterm elections.

Key Conclusions

- The president’s party typically loses seats in Congress in midterm elections

- Market returns tend to be muted until later in midterm years

- Midterm election years have had higher volatility

- Market returns after midterm elections have been strong

- Stocks have done well regardless of the makeup of Washington

- Historically, elections have had little impact on long-term investment returns

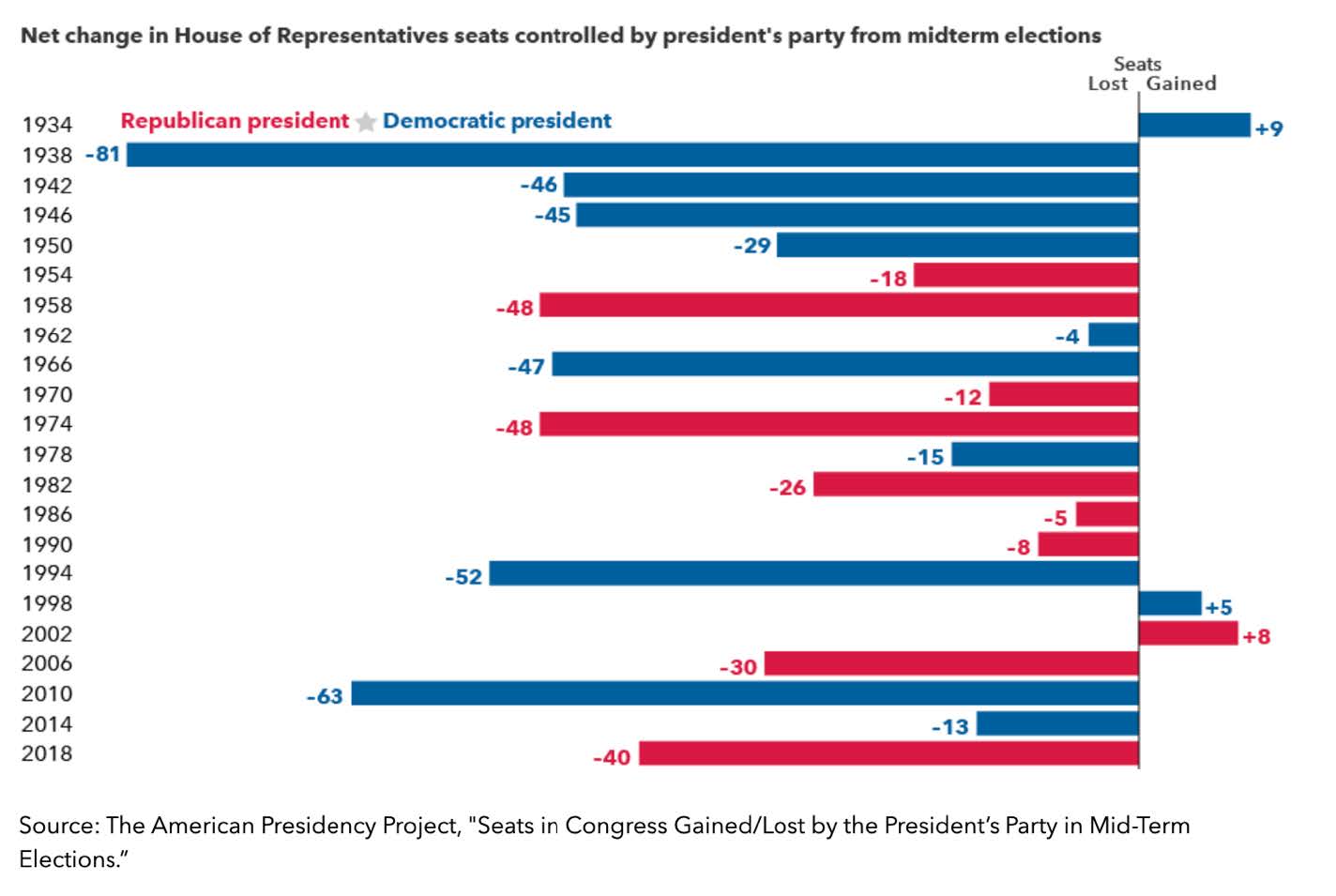

Changes in Congressional Seats

One can come up with a lot of reasons for these outcomes. A president’s approval rating tends to drop in the first 2 years in office and supporters of the party not in power tend to be more motivated to get out and vote. It is safe to say that we will see a backlash against the Biden administration and the Democrat controlled Congress this time around. The House will almost certainly flip to GOP control. The Senate is a close toss-up at the moment.

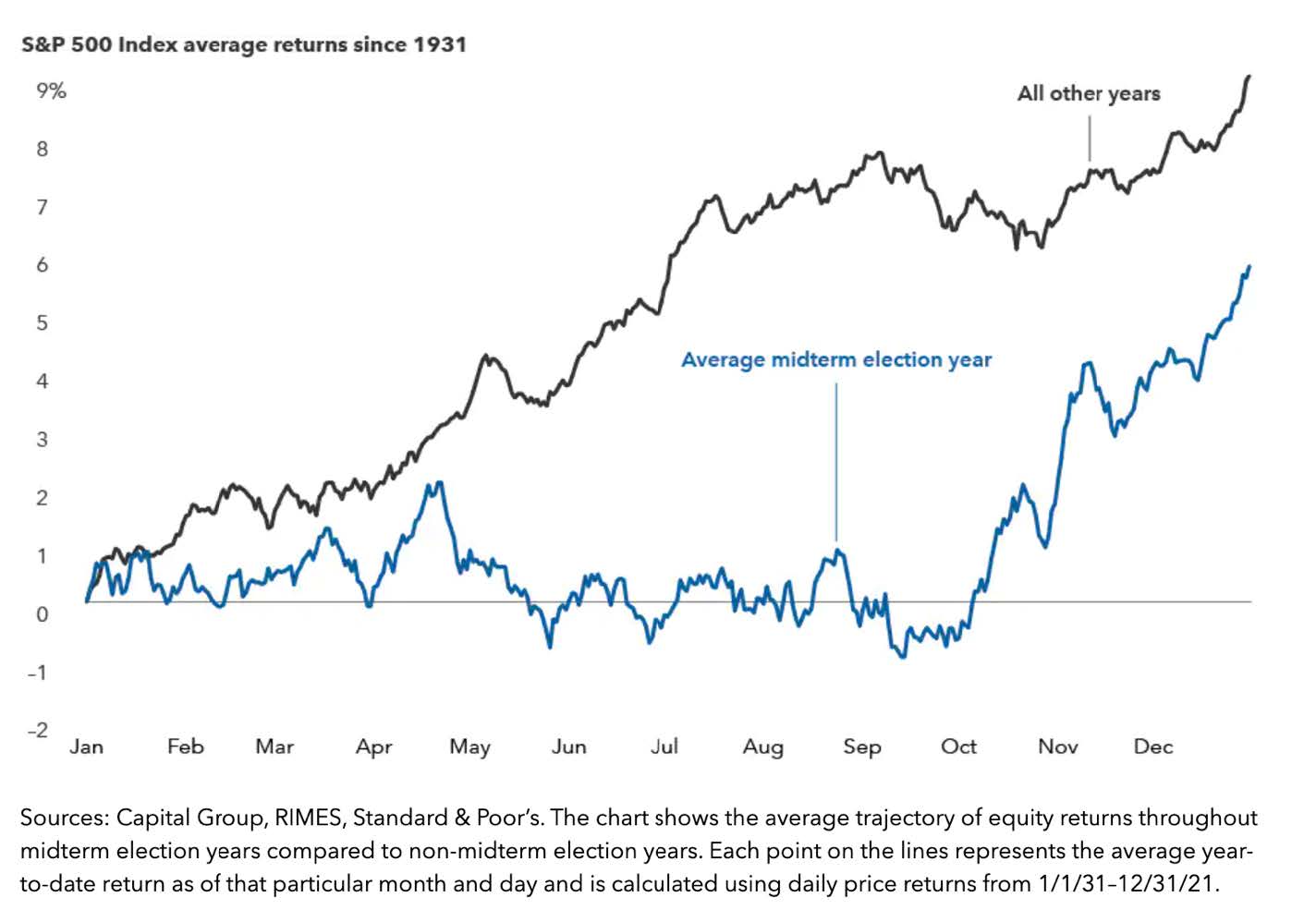

Market Returns During Midterm Years

The graph below shows how markets tend to be muted in the months leading up to a midterm election and then begin to rally in the few weeks before an election.

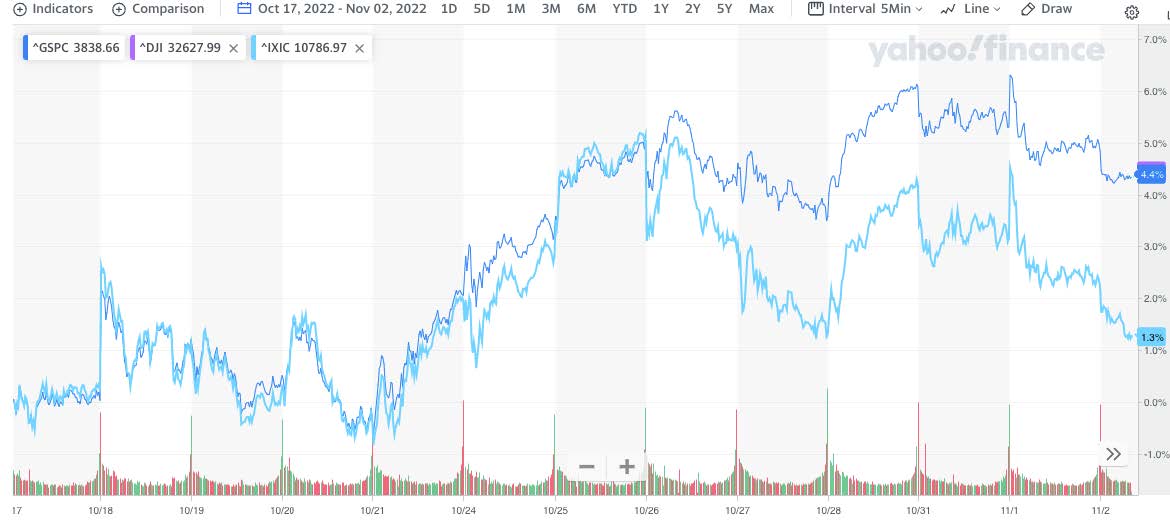

Below is a chart beginning October 17 through November 2. It shows that we are seeing a bit of a rally since mid-October as election day approaches. The underperformance of the NASDAQ and pullback in the S&P 500 is largely due to several mega capitalization technology companies reporting disappointing earnings for the third quarter. If history holds, and with third quarter earnings season wrapping up, we will hopefully experience a similar continuation of the upward market trends.

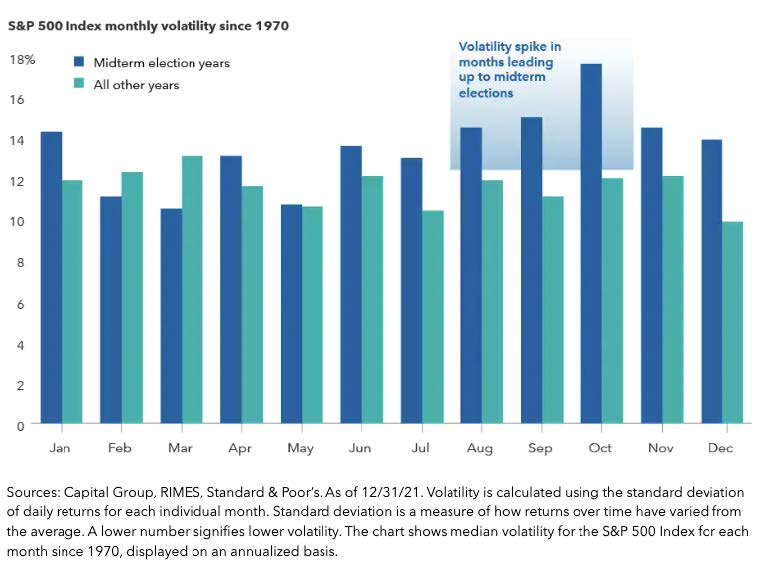

Increased Market Volatility in Midterm Election Years

In addition to late year rallies during midterm election years, the markets tend to be more volatile than normal. Investors’ nerves seem to be impacted by campaign strategies that both parties use that go big on negative messaging. Candidates often draw attention to the country’s problems, and campaigns regularly amplify negative messages. Policy proposals are fuzzy and often target specific industries or companies. The bar chart below illustrates this point.

Post-Election Rebound

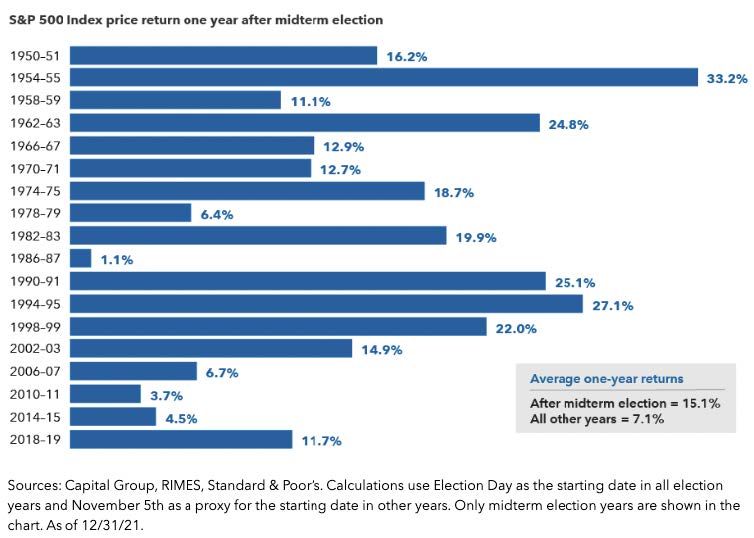

The good news for investors is that historically markets have extended strong positive performance in the months following midterm elections. Not every cycle is the same and this time around is no different. There are many factors the markets are facing at the moment including inflation, both domestic and globally, and a whole lot of geopolitical concerns. The bar chart below shows the history of post-midterm election returns from 1950 to 2019. We will learn soon enough if history repeats itself.

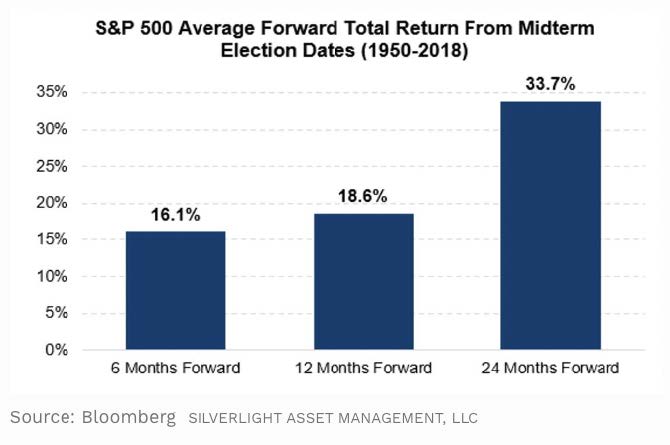

Here is a bar graph that shows performance looking out even further after midterm elections.

Does the Party in Power Matter?

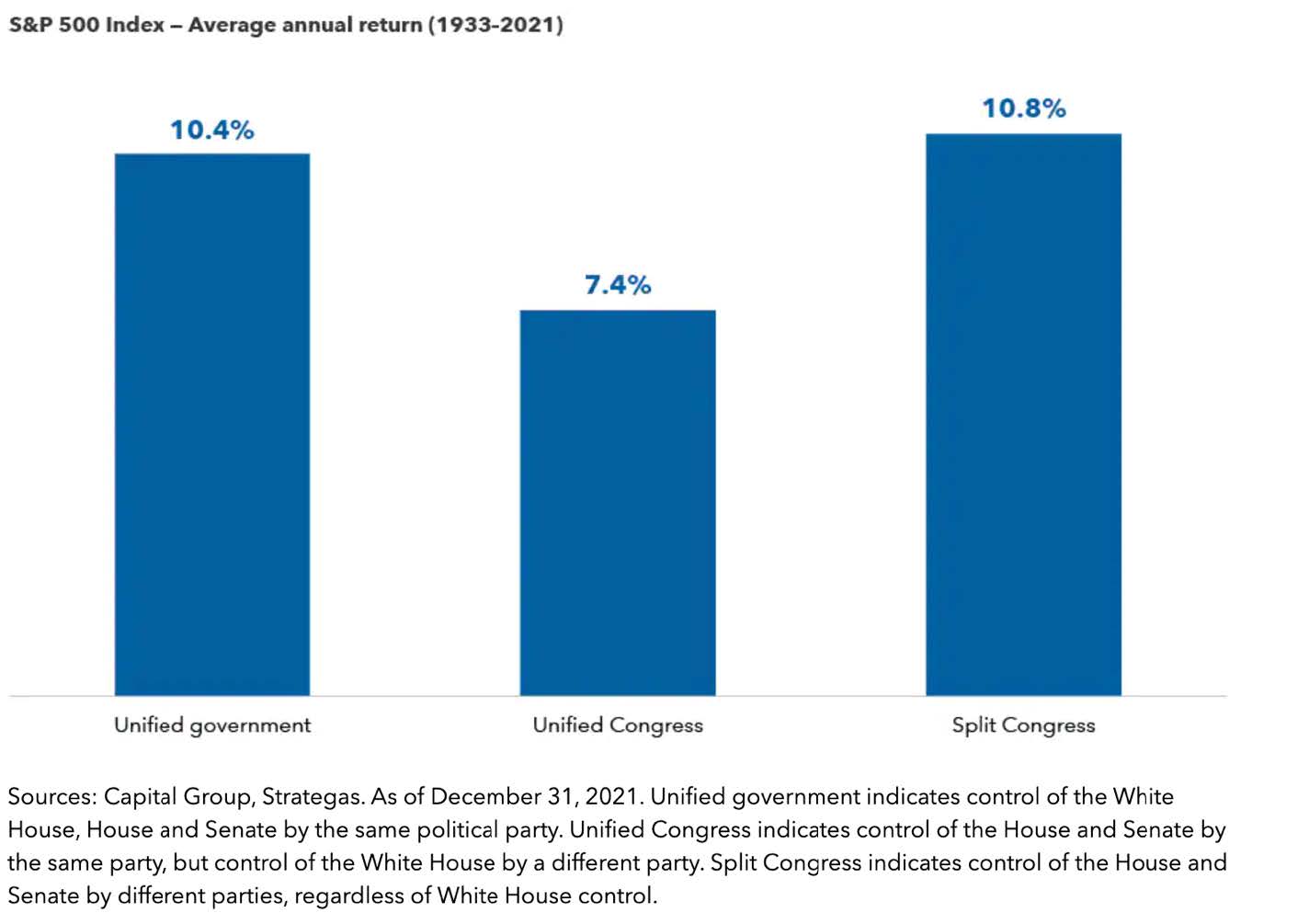

In short, no. I found analysis of market performance going back to 1933 that shows that markets have averaged double-digit returns in all years when a single party controlled the White House, the Senate, and the House of Representatives. It really makes no difference which party investors prefer. I would encourage folks to not place too much emphasis on election outcomes because, historically, elections have had little impact on long-term investment returns.

Wrapping Up

When all is said and done, the message here is that long term market returns come from the changing value of companies over time. On a short-term basis, during election cycles, we can see higher volatility leading to increased fears regarding market performance. We are in a period of great uncertainty which will be partially alleviated once we get past this election and the results are finalized. On a side note, it could take several days — if not weeks — before all the election results are certified which could potentially keep investors on edge

until then. We remain very focused on the long term in times like these. Please reach out to me or anyone on the team if you have questions or interest in talking about any of this further.