The correction in the markets has been hard to bear. In the face of this decline in the markets, our commitment to long term investment strategies has not changed. We are in this for the long haul and our job is to help our clients manage their way through such times as these.

“Loss aversion is as much a physiological construct as it is a psychological one. They found enhanced activity in the reward circuitry of the brain as gains were made but even stronger responses to potential losses—something the researchers dubbed “neural loss aversion.” The fear of loss and the attendant behavioral paralysis that can accompany fear have biological roots, but they must be shaken if we are to achieve our true potential as people and investors. We are wired to hate loss and volatility but learning to cope with them is the only means most investors have for achieving the returns necessary to meet their long-term goals.”

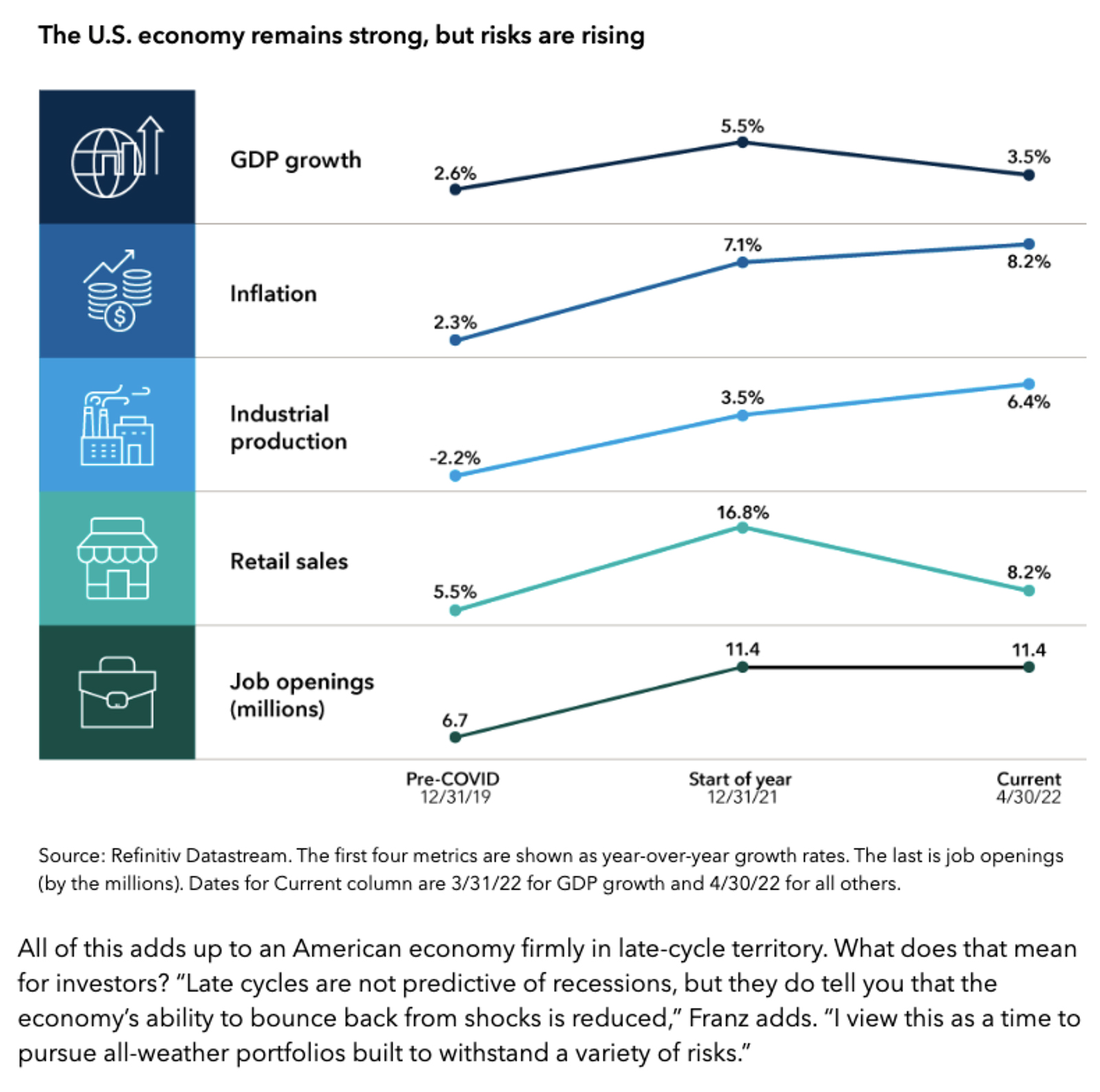

The Economy

Let’s not ignore the fact that the economy is still growing, and the world is not coming to an end. Below is from a presentation from the Capital Group, a company I respect and interacted with for years during my institutional brokerage days.

All-weather relates to companies that consistently raise their dividend each year along with seeking out companies in defensive areas of the market such as healthcare and non-discretionary spending to name a couple.

The Consumer – Fitch Ratings Observations

Fitch Ratings-New York-08 June 2022: Strong growth in employment and nominal wages are supporting a positive near-term growth outlook for U.S. household income and consumption despite the sharp rise in consumer price inflation, according to Fitch Ratings.

Concerns that high inflation could squeeze U.S. real household incomes and consumption have been offset by strong labor income growth.

“Given broad based evidence of very tight labor market conditions, a wage price spiral looks like the more immediate risk rather than a sharp slowdown in consumption driven by falling real incomes,” said Olu Sonola, Head of U.S. Regional Economics.

Inflation

Some views are that there is a tremendous amount of unsold inventory in the system which should push prices down at some point and take some of the steam out of inflation. Case in point. Target warned of large amounts of inventory, mostly larger ticket items, are building and they will begin implementing markdowns to move it out. Walmart, GAP and Urban Outfitters have indicated similar situations.

While we all understand that food and energy prices are impacting inflation more than anything else, how long and how much more they will push inflation higher is certainly up for debate. “Transitory” inflation is now a dirty word. It goes without saying that Russian’s invasion of Ukraine is the major reason we are where we are on that front. How and when that conflict appears to be reaching a conclusion will be a very important catalyst to turning this market around. Until then, a peaking in gas prices should (emphasis on should) occur as the summer driving season comes to an end and hopefully give us a bit of a reprieve.

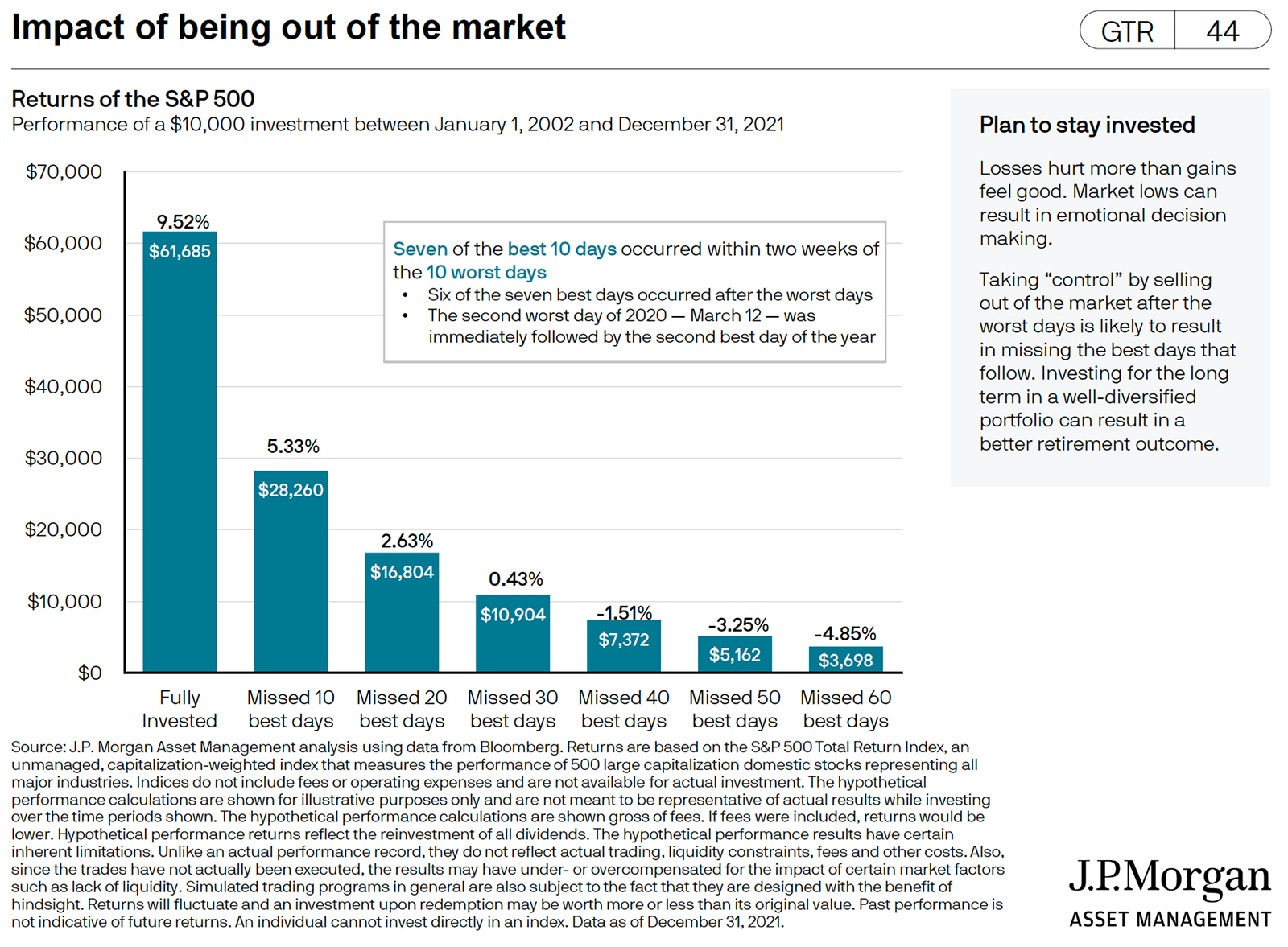

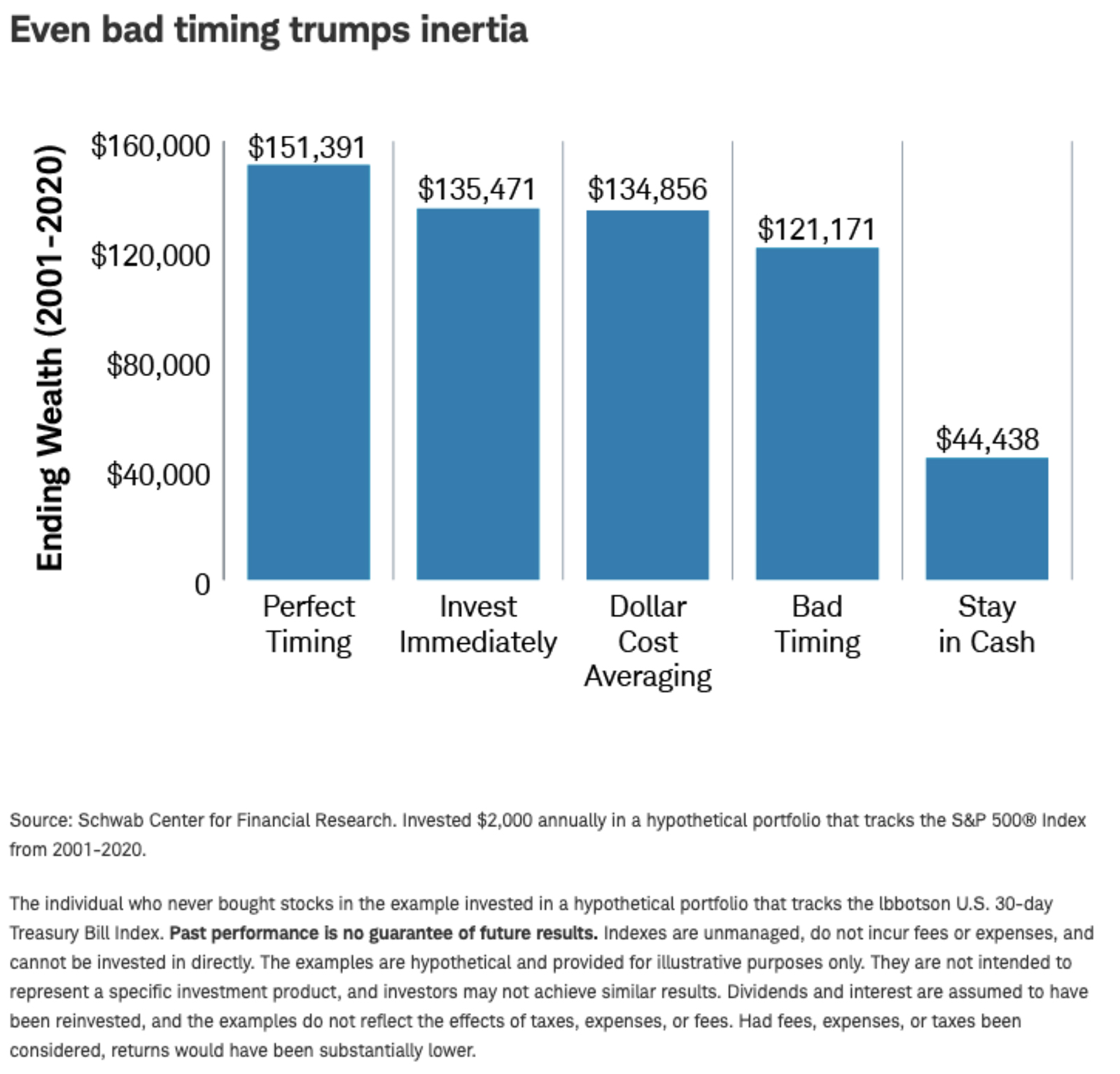

Trying to Time Markets – Some Illustrations on the Risks of That Strategy

Bottomline is “Invest when you have the funds available and STAY INVESTED!”

Wrapping Up

We know and understand why many of you are fearful of what the future holds for your retirement. As your financial advisors, have been here many times. We are eager and available to speak with you more in depth regarding any fears/concerns you may have in the current market environment.