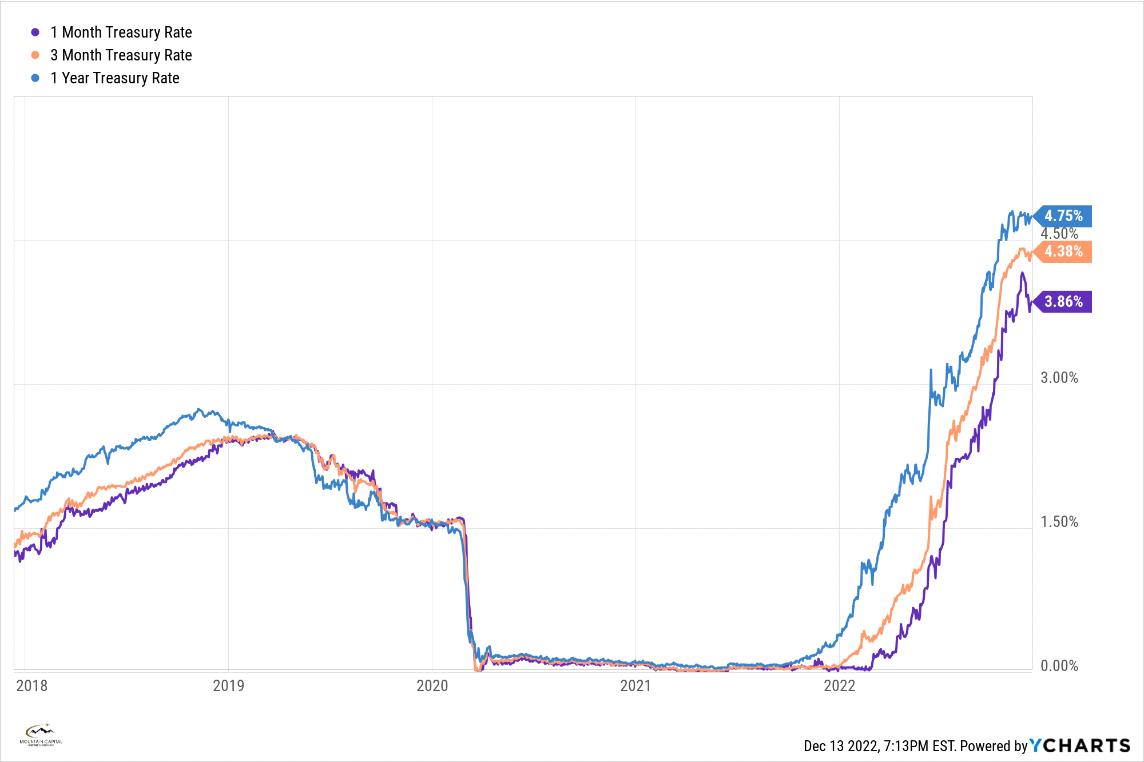

As the Covid pandemic unfolded in early 2020, interest rates on one-year government debt plunged from 1.5 % to near zero in a matter of weeks. From March of 2020 to near the end of 2021, the one-year rate hovered between 0.05% and 0.12%. Rates that low are almost irrelevant.

As the Federal Reserve launched their war on inflation, albeit a little late, short term interest rates began to soar early this year reaching levels currently approaching 4.75%. For people dependent on investment income, this is very good news.

Here is a chart of one month, three month and one year Treasury rates going back five years.

Fixed Income Strategy

Throughout the year, we have been constantly shifting our fixed income strategies to take advantage of rising rates. Early this year we began to shift from away longer maturity bond investments into shorter term investments, both corporate and government. As many of you are aware, we have used bond mutual funds for much of our income strategy. Over the past 3 months, we have incorporated a significant amount of direct investment in short term government debt into our cash and fixed income strategies.

It has been a very difficult year for fixed income investing but we firmly believe that we are in an environment now that will continue into next year where bond investing will be a strong contributor to current income and long-term returns.

Income Expectations for 2023

Broadly speaking, we expect to see increases in income generation of 25-30% in dollar terms from our income strategy as we head into 2023. For clients in or near retirement, this is very good news. If the bond market rallies when the Fed signals that rate hikes will slow, that will only improve the performance of bonds in portfolios through capital appreciation, reversing what we have lived through this year. 2023 should be a great year for fixed income performance.

High Inflation Leads to Higher Limits for Retirement Plans

Another silver lining to the current environment of high inflation is that it is leading the IRS to increase maximum allowable pre-tax contributions to retirement plans for 2023.

Here is a table laying out the changes compared to 2022 levels:

| Compensation & Benefits Limits | 2023 | 2022 |

|---|---|---|

| Individual Retirement Accounts – Traditional and Roth | $6,500 | $6,000 |

| IRA Catch Up Deferral Limit – Traditional and Roth | $1,000 | $1,000 |

| 401(k)/403(b) Plan Deferral Limit | $22,500 | $20,500 |

| Catch-Up Contributions (401(k), 403(b) & Governmental 457(b) Plans) | $7,500 | $6,500 |

| Defined Contribution Dollar Limit | $66,000 | $61,000 |

| 457(b) Plan Deferral Limit | $22,500 | $20,500 |

| Social Security Taxable Wage Base | $160,200 | $147,000 |

You will also notice at the bottom of the table that the Social Security Taxable wage base, the level where you stop paying Social Security taxes has gone up $13,200. That is the one aspect of rising rates that we don’t like but with all the increases in contribution limits, the taxpayer clearly benefits more overall heading into 2023.

Outlook for 2023

I receive numerous reports and commentaries from all manner of research and brokerage firms almost daily. I try to read all of them to get a sense for what well known strategists and economists are thinking about regarding the market as we approach 2023.

On inflation, it is clear that the rising trend has begun to reverse course at a slow pace. The most recent October Consumer Price Index numbers came out on 12/13/2022 and surprised the market by showing that year over year inflation declined more than analysts had been expecting. I have written before that inflation numbers are backward looking. That said, it is nice to see the bond market rally on the CPI news driving interest rates slightly lower.

Looking forward, gasoline prices are now below where they were a year ago, used car and truck prices have stabilized and apparel prices have declined roughly 0.5% over the last two reports. Mortgage rates have also begun to decline with the average rate on a conventional 30-year mortgage now at 6.28%, its lowest level since mid-September. That’s good news for homebuyers but I don’t expect demand to increase much given that current rates are still twice what they were a year ago.

As for the markets, we are coming off a year where both stocks and bonds moved into negative territory, something that is more the exception than the norm. For 2023, I expect we will experience mild rebounds in stocks and bonds, more likely in the second half of the year. I do expect that the markets will rally when the Fed signals that their policy of raising the Fed Funds rate to calm the economy is ending. The Fed has an inflation target of between 2-3% so we have a way to go yet.

Wrapping Up

My message is that a return to more normalized levels in interest rates and inflation should lead to a modest market rebound in 2023. The global economy continues to be impacted by Covid, especially in China as we all know. The war in Ukraine clearly remains a factor that dampens economic activity across much of eastern Europe. I could list additional headwinds but for the most part, much of the negative impacts from economic and supply chain issues have already been baked into market expectations in my humble opinion.

As I started out in this commentary, I focused on the sharp rise in income generation heading into 2023 which will provide some much-needed tailwind to overall investment returns. That said, I do feel the markets will unfortunately continue to be volatile well into next year. When the Fed reverses course, I am confident that the stock market will respond favorably, and stock valuations can rebound to more appropriate levels. We are in this for the long haul as you know so we will continue to update our investment strategies as appropriate as 2023 unfolds.

From everyone on the Mountain Capital team, we wish you all a safe and happy holiday with family and friends. Enjoy some cheer knowing that we are putting this year behind us and look forward to a more prosperous new year.